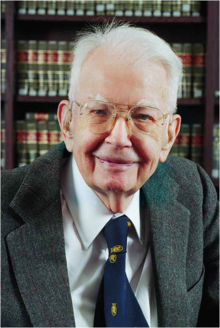

Ronald Coase

Ronald Coase was a British-born American economist who won the 1991 Nobel Prize in Economics for his significant work in transactions costs and property rights in the functioning of the economy (Coase Institute). Born on December 29, 1910, Mr. Coase attended the University of London and the London School of Economics, where he got his Bachelor's degree. He worked at LSE for fifteen years before moving to the University of Buffalo in the mid-1950s. After a brief stint at the University of Virginia from 1958 to 1964, he moved to the University of Chicago, where he was the Clifton R. Musser Professor Emeritus of Economics, and stayed as a distinguished faculty member for the rest of his academic career.

Mr. Coase's work was influential for many reasons but he is especially known for these two: transactions costs of the firm, and how property rights could overcome externalities. The first, he published when he was only 26 years old, in a paper titled "The Nature of the Firm" (1937). In this seminal piece, Mr. Coase tries to explain why people choose to organize themselves into business firms rather than each contracting out the work for themselves. Coase's main explanation for this is that there are various transactions costs related to functioning in the open market that are eliminated when people create companies instead of subcontracting. For example, a certain person and his subcontractor would need to spend time bartering before agreeing on a price and this hassle is stricken through the organization of corporations, where many jobs and functions can be performed in-house.

The second reason, involving property rights, Coase published in a paper named "The Problem of Social Cost" (1960) in the Journal of Law and Economics while he was a faculty member at the University of Virginia. In this paper, Coase writes that it is unclear where the blame for externalities or negative consequences lie. He concludes that is important that the government clearly define property rights so that the question of who, in an economic scenario involving two or more parties, is the more harmed by a certain choice or action. In his words, "the problem is to avoid the more serious harm". Together with sufficient transaction costs, initial property rights matter for both equity and efficiency.

This leads to the famous "Coase Theorem" which is associated closely with Ronald Coase, who said that the theorem, taken from a few pages of his "The Problem of Social Cost" paper, was not about his work at all. Even though Coase said in his paper that property rights should be well defined, the Coase Theorem posits that if trade in an externality is possible and there are no transaction costs, then bargaining will lead to an efficient outcome regardless of the initial allocation of property (Wikipedia). In essence, involved parties don't have to consider how property rights are granted so long as they can negotiate and trade to produce a mutually advantageous outcome. His 1960 paper, however, argues that since transactions costs are rarely low enough to produce such an efficient outcome, the theorem is not applicable to economic reality.

Before reading about Mr. Coase in the New York Times last week, I knew nothing about him. I certainly did not know he was a Nobel Prize winner and such an esteemed luminary in the field of economics. Mr. Coase contributed a great deal and amount of research, and was arguably one of the greatest economists of the twentieth century. His inadvertent creation of the Coase Theorem has led to countless papers and research in the subfields of perfect competition, game theory, and the economics of government regulation. His work on transactions costs, social costs, and especially the nature of the firm, will be highly relevant to our class since we do talk about the economics of organizations. Ronald Coase died on September 2, 2013, at the age of 102.

Coase also wrote about the "Durable Goods Monopolist" and developed something called the "Coase Conjecture" which says the already sold items that are perfect substitutes for new items (think of used textbooks) will compete with new sales, thereby eliminating the monopoly power of the seller. The textbook publishers understand this result all too well, which is the main reason why new editions of the book come out every so often. It is also why they like eBooks, where there is no resale possibility.

ReplyDelete